Navigating the Oil Patch Calendar: A Guide to Understanding the Industry’s Rhythms

Related Articles: Navigating the Oil Patch Calendar: A Guide to Understanding the Industry’s Rhythms

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Oil Patch Calendar: A Guide to Understanding the Industry’s Rhythms. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Oil Patch Calendar: A Guide to Understanding the Industry’s Rhythms

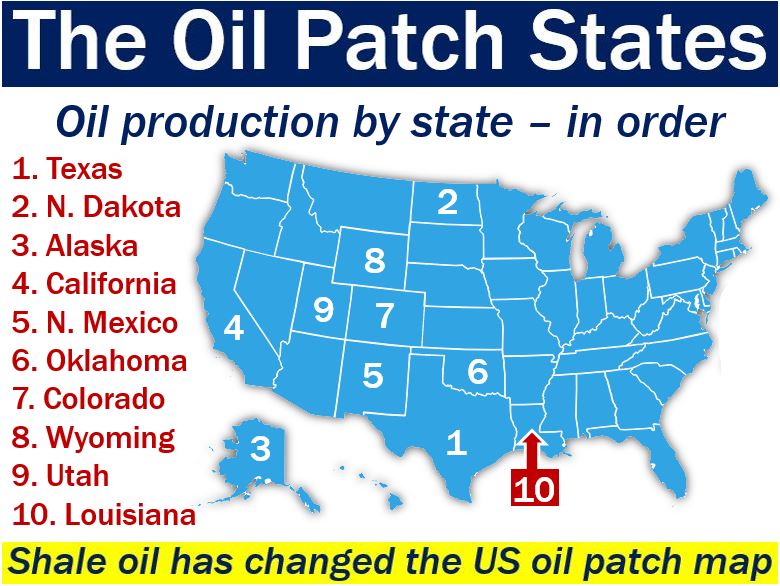

The oil and gas industry operates within a complex and dynamic ecosystem, subject to a myriad of factors influencing its ebb and flow. Understanding this intricate dance requires a deep understanding of the industry’s unique rhythms, often encapsulated in the concept of the "oil patch calendar." This calendar is not a literal calendar with dates and events, but rather a framework for understanding the cyclical nature of the oil and gas industry, driven by factors such as seasonal demand, weather patterns, and regulatory cycles.

Key Elements of the Oil Patch Calendar

The oil patch calendar encompasses several key elements that influence the industry’s activity and performance:

1. Seasonal Demand: Energy consumption fluctuates throughout the year, primarily driven by weather patterns. Winter months see a surge in heating demand, leading to increased oil and gas production and consumption. Conversely, summer months often witness a decline in heating demand, impacting production and pricing.

2. Weather Patterns: Weather plays a crucial role in oil and gas operations. Extreme weather events, such as hurricanes, blizzards, and floods, can disrupt production, transportation, and refining activities, impacting supply chains and prices.

3. Regulatory Cycles: The oil and gas industry is subject to a complex web of regulations, both at the national and international levels. These regulations, often undergoing revisions and updates, can influence exploration, production, and environmental practices, impacting operational costs and project timelines.

4. Commodity Prices: Oil and gas prices are inherently volatile, influenced by global demand, geopolitical events, and economic conditions. Fluctuations in commodity prices directly impact industry profitability and investment decisions.

5. Economic Cycles: The overall economic climate significantly affects oil and gas demand. Periods of economic growth often see increased demand for energy, while recessions can lead to a decline in consumption.

Understanding the Impact of the Oil Patch Calendar

The oil patch calendar’s influence extends beyond the immediate impact on production and prices. It shapes the industry’s decision-making processes, investment strategies, and long-term planning.

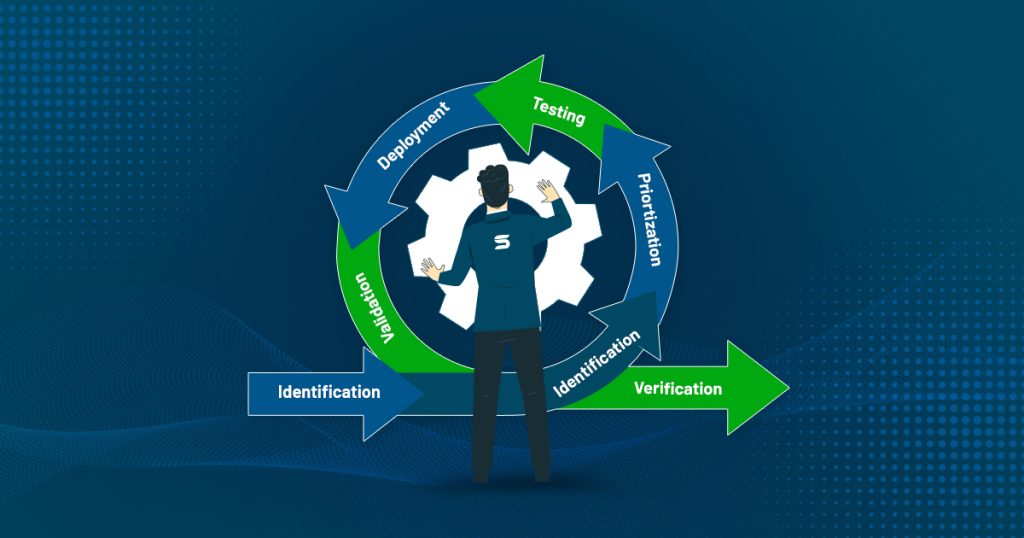

1. Investment Cycles: Companies often align their investment decisions with the oil patch calendar, allocating capital during periods of high demand and low prices, while scaling back investments during periods of low demand and high prices.

2. Operational Planning: Understanding the cyclical nature of the industry allows companies to optimize their operations. For example, maintenance and repair activities can be scheduled during periods of lower demand, minimizing disruptions to production.

3. Risk Management: The oil patch calendar helps companies identify and mitigate risks associated with seasonal demand, weather patterns, and regulatory changes. By anticipating potential disruptions, companies can develop contingency plans and ensure operational continuity.

4. Strategic Decision-Making: The oil patch calendar provides a framework for making informed strategic decisions, taking into account the industry’s cyclical nature and potential future trends.

Benefits of Understanding the Oil Patch Calendar

A comprehensive understanding of the oil patch calendar offers numerous benefits for individuals and organizations operating within the industry:

- Enhanced Decision-Making: By anticipating industry trends and fluctuations, decision-makers can make more informed choices regarding investments, operations, and risk management.

- Improved Profitability: Understanding the cyclical nature of the industry can help companies optimize their operations and maximize profitability.

- Reduced Risk: By anticipating potential disruptions and developing contingency plans, companies can minimize their exposure to risks associated with weather, regulations, and market volatility.

- Increased Efficiency: By aligning operational activities with the oil patch calendar, companies can improve efficiency and productivity.

- Enhanced Competitiveness: A deep understanding of the industry’s rhythms can give companies a competitive edge, allowing them to anticipate market shifts and capitalize on opportunities.

Frequently Asked Questions (FAQs) about the Oil Patch Calendar

1. What is the best time of year to invest in the oil and gas industry?

The ideal time to invest depends on individual investment strategies and market conditions. However, periods of low demand and low prices are generally considered favorable for investment, as companies may be undervalued and offer greater potential for growth.

2. How does the oil patch calendar impact the price of oil and gas?

The oil patch calendar influences oil and gas prices through seasonal demand, weather patterns, and regulatory changes. For example, increased demand during winter months can lead to higher prices, while disruptions caused by extreme weather events can disrupt supply chains and drive prices up.

3. How can I stay informed about the oil patch calendar?

Staying informed about the oil patch calendar requires monitoring industry news, reports, and data. Following industry publications, attending conferences, and engaging with industry experts can provide valuable insights.

4. Is the oil patch calendar a reliable predictor of future trends?

The oil patch calendar provides a framework for understanding the industry’s cyclical nature, but it is not a foolproof predictor of future trends. External factors, such as geopolitical events and technological advancements, can also significantly impact the industry.

Tips for Navigating the Oil Patch Calendar

- Stay Informed: Maintain a consistent awareness of industry news, reports, and data to stay abreast of current trends and anticipate potential shifts.

- Diversify Investments: Spread your investments across different segments of the oil and gas industry to mitigate risk and capitalize on opportunities.

- Develop Contingency Plans: Anticipate potential disruptions and develop contingency plans to ensure operational continuity during periods of high volatility.

- Monitor Regulations: Stay informed about regulatory changes and their potential impact on your operations and investments.

- Embrace Technology: Utilize technology to optimize operations, improve efficiency, and enhance decision-making.

Conclusion

The oil patch calendar serves as a valuable framework for understanding the complex and dynamic nature of the oil and gas industry. By recognizing the industry’s cyclical rhythms, individuals and organizations can make more informed decisions, improve profitability, mitigate risks, and enhance their overall competitiveness. Staying informed, adapting to change, and embracing technology are essential elements for navigating the oil patch calendar successfully and thriving in this dynamic industry.

![]()

Closure

Thus, we hope this article has provided valuable insights into Navigating the Oil Patch Calendar: A Guide to Understanding the Industry’s Rhythms. We appreciate your attention to our article. See you in our next article!