Navigating the Ohio Payroll Calendar: A Comprehensive Guide for 2025

Related Articles: Navigating the Ohio Payroll Calendar: A Comprehensive Guide for 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Ohio Payroll Calendar: A Comprehensive Guide for 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Ohio Payroll Calendar: A Comprehensive Guide for 2025

The Ohio Payroll Calendar is a vital tool for businesses and individuals alike, providing a clear roadmap for payroll deadlines and ensuring compliance with state and federal regulations. This guide aims to provide a comprehensive overview of the Ohio Payroll Calendar for 2025, offering insights into its structure, key dates, and importance in managing financial obligations.

Understanding the Ohio Payroll Calendar

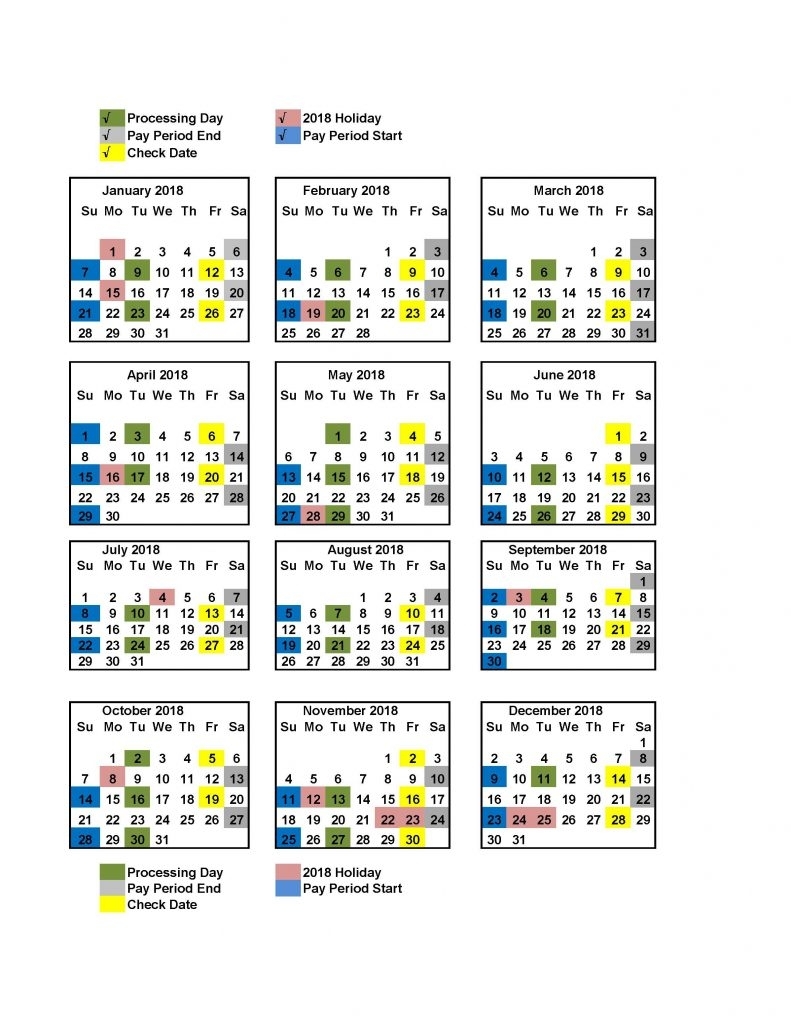

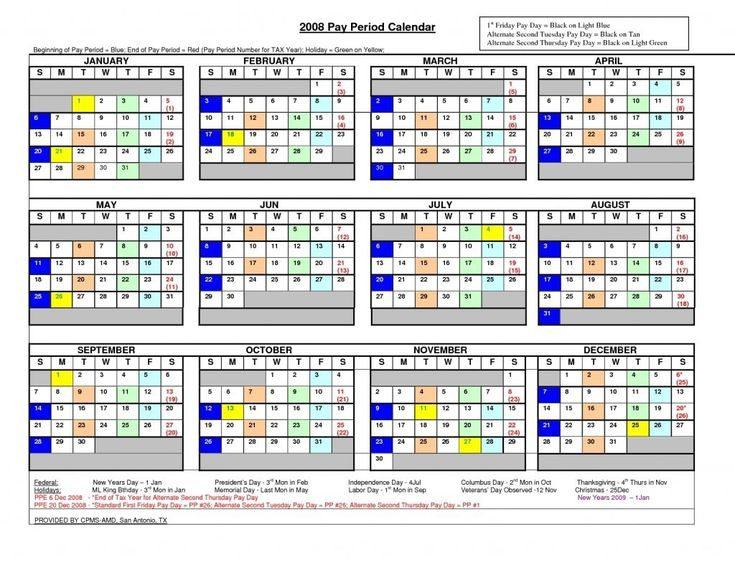

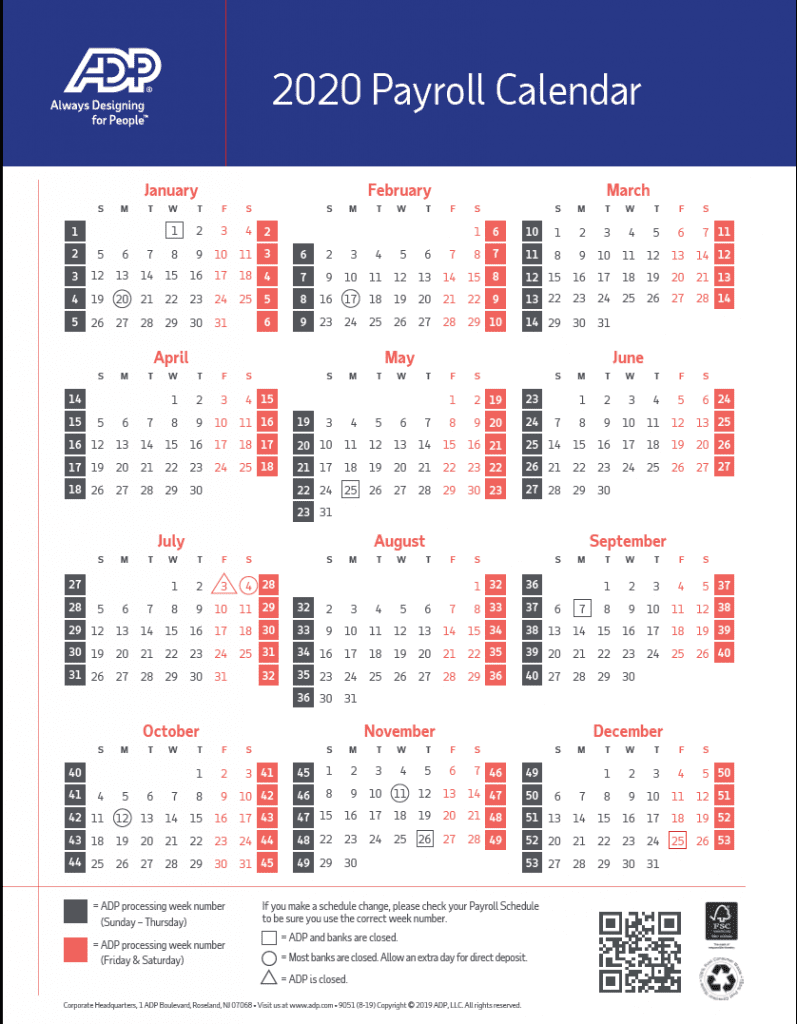

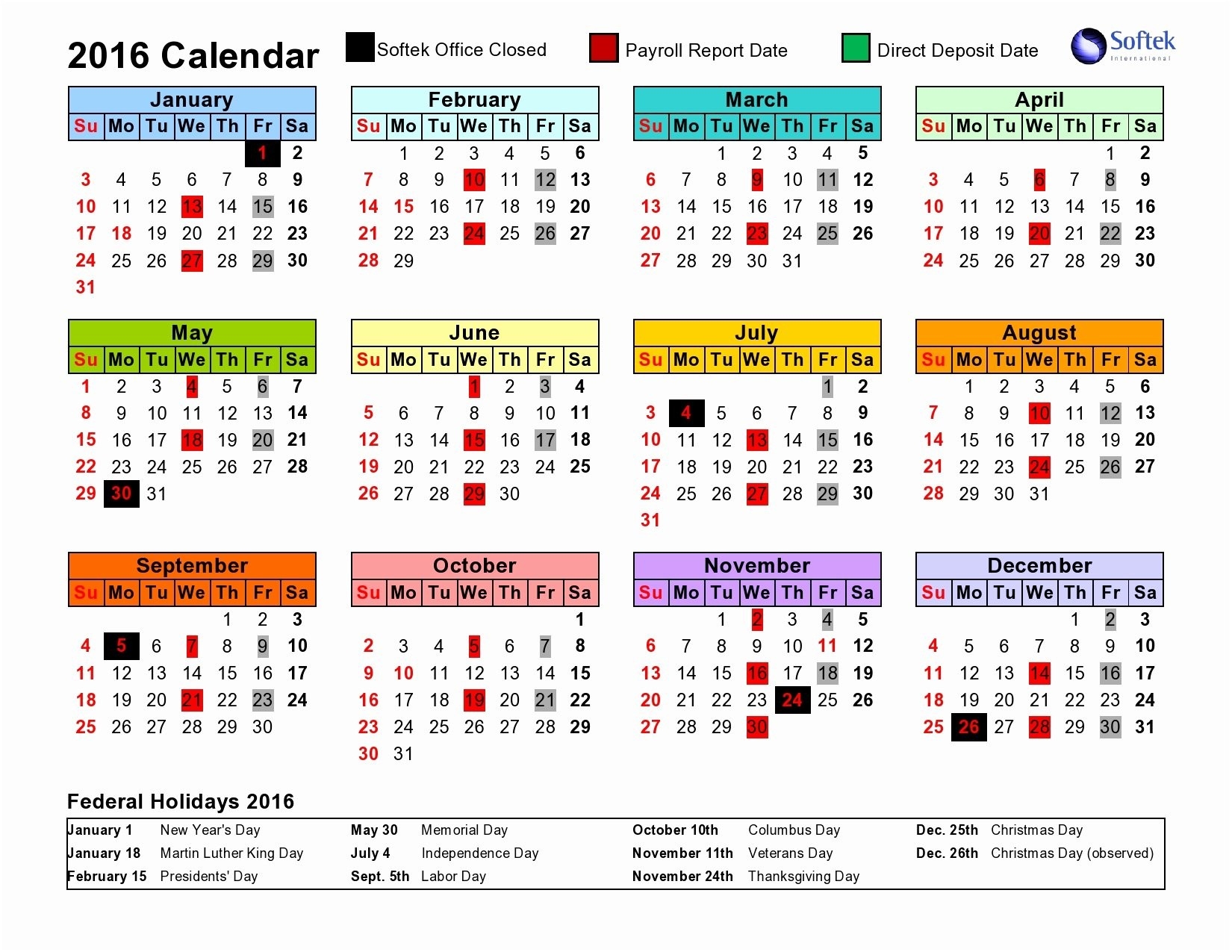

The Ohio Payroll Calendar outlines the specific dates when payroll taxes and other related payments are due to the state. These dates are determined by the Ohio Department of Taxation and are typically based on the day of the week and the corresponding pay period.

Key Dates and Deadlines

The 2025 Ohio Payroll Calendar will feature a series of key dates, each with its own significance for payroll processing. These dates typically include:

- Quarterly Tax Deadlines: Businesses are required to file and pay quarterly payroll taxes, including income tax withholding, unemployment insurance contributions, and other applicable taxes. The exact dates for quarterly filings will be specified on the calendar.

- Annual Tax Deadlines: Annual tax filings and payments for payroll taxes are due on a set date, typically in January or February of the following year. The Ohio Payroll Calendar will clearly indicate this deadline.

- Withholding Deadlines: Employers are responsible for withholding income tax from employee paychecks and remitting these withholdings to the state. The calendar will specify the frequency of these withholdings, which may be weekly, bi-weekly, or monthly.

- State and Federal Holidays: Holidays can affect payroll deadlines, as they may cause shifts in regular payment schedules. The Ohio Payroll Calendar will account for any holiday-related adjustments.

Importance of the Ohio Payroll Calendar

The Ohio Payroll Calendar serves as a vital resource for businesses and individuals for several reasons:

- Compliance: Adhering to the designated deadlines ensures compliance with state and federal tax regulations, preventing penalties and legal issues.

- Financial Management: The calendar allows for efficient planning and budgeting, ensuring that funds are allocated appropriately for payroll taxes and other related expenses.

- Accuracy: The calendar provides a clear and consistent framework for payroll processing, reducing the risk of errors and miscalculations.

- Time Management: By adhering to the calendar’s schedule, businesses can streamline payroll processes, optimizing efficiency and productivity.

Benefits of Utilizing the Ohio Payroll Calendar

- Reduced Risk of Penalties: Using the calendar ensures timely payments, minimizing the chance of incurring late fees and penalties.

- Improved Financial Planning: The calendar provides a clear understanding of future financial obligations, facilitating accurate budgeting and resource allocation.

- Enhanced Efficiency: The calendar’s structure promotes a standardized and organized approach to payroll processing, streamlining operations and reducing administrative burdens.

Accessing the Ohio Payroll Calendar

The Ohio Payroll Calendar is readily available on the Ohio Department of Taxation website. The website typically provides a downloadable calendar format that can be easily accessed and printed for reference.

FAQs about the Ohio Payroll Calendar

Q: What if a payroll deadline falls on a weekend or holiday?

A: If a deadline falls on a weekend or holiday, it is typically extended to the next business day. The Ohio Payroll Calendar will clearly indicate any such adjustments.

Q: What are the consequences of missing a payroll deadline?

A: Missing a deadline can result in penalties, including late fees and interest charges. In some cases, failure to comply with payroll regulations could lead to legal action.

Q: Can I make changes to the payroll calendar?

A: The Ohio Payroll Calendar is a state-mandated document and cannot be altered by individuals or businesses. It is essential to adhere to the published deadlines.

Q: How can I stay informed about updates to the Ohio Payroll Calendar?

A: The Ohio Department of Taxation website is the primary source for updates and changes to the calendar. It is advisable to check the website regularly for any modifications.

Tips for Using the Ohio Payroll Calendar Effectively

- Mark Key Dates: Highlight important deadlines on the calendar to ensure timely payments and filings.

- Set Reminders: Use electronic reminders or calendar alerts to avoid missing critical deadlines.

- Communicate with Employees: Inform employees about payroll deadlines and any potential changes in payment schedules.

- Consult with Professionals: If you have questions or require assistance with payroll processing, consult with a qualified tax professional.

Conclusion

The Ohio Payroll Calendar is a fundamental tool for managing payroll obligations and ensuring compliance with state regulations. By understanding its structure, key dates, and importance, businesses and individuals can navigate the complexities of payroll processing with confidence and efficiency. Utilizing the calendar effectively promotes financial stability, minimizes risks, and fosters a smooth and compliant payroll system. Regular review of the Ohio Payroll Calendar and adherence to its deadlines are crucial for maintaining a healthy financial standing and avoiding potential penalties.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Ohio Payroll Calendar: A Comprehensive Guide for 2025. We hope you find this article informative and beneficial. See you in our next article!