Navigating the Labyrinth: Understanding the Stock Market Reporting Calendar

Related Articles: Navigating the Labyrinth: Understanding the Stock Market Reporting Calendar

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Labyrinth: Understanding the Stock Market Reporting Calendar. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Labyrinth: Understanding the Stock Market Reporting Calendar

The stock market, a complex and dynamic ecosystem, thrives on information. This information, disseminated through a series of reports and announcements, provides investors with crucial insights into the financial health and future prospects of publicly traded companies. Understanding the timing and significance of these reports is paramount for making informed investment decisions. This is where the stock market reporting calendar comes into play, acting as a compass guiding investors through the labyrinth of financial data.

Decoding the Calendar: A Comprehensive Guide

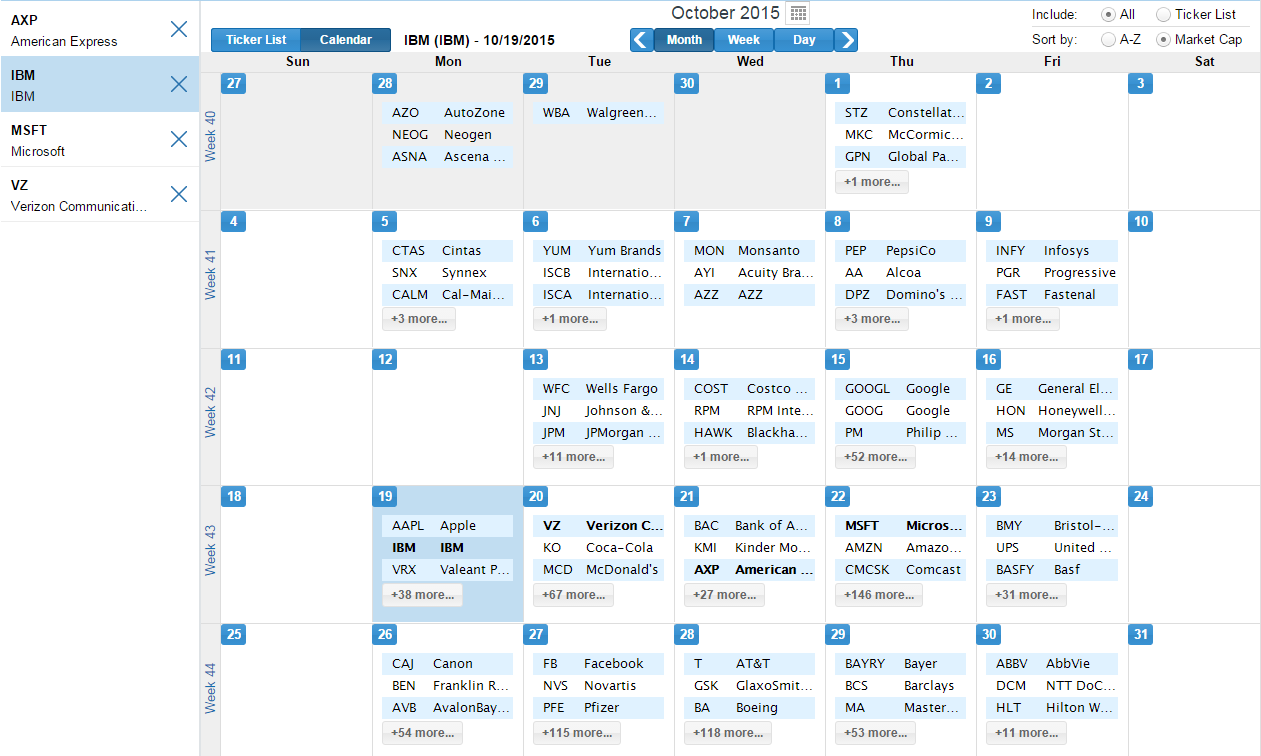

The stock market reporting calendar, a meticulously organized schedule, outlines the key dates for various financial reports and announcements. It serves as a central hub, providing investors with a clear view of the reporting landscape. This calendar encompasses a wide range of events, each carrying its own weight and implications for the market.

Key Components of the Stock Market Reporting Calendar:

-

Earnings Reports: The cornerstone of the calendar, earnings reports offer a detailed snapshot of a company’s financial performance over a specific period. They typically include revenue, net income, earnings per share (EPS), and other key metrics. Analysts and investors eagerly await these reports, as they provide valuable insights into a company’s profitability and growth trajectory.

-

Economic Indicators: The calendar also includes key economic indicators, such as the Consumer Price Index (CPI), unemployment rate, and gross domestic product (GDP) growth. These indicators provide insights into the overall health of the economy, influencing investor sentiment and stock market performance.

-

Federal Reserve Meetings: The Federal Reserve, the central bank of the United States, plays a pivotal role in setting interest rates and managing the money supply. The calendar highlights the dates of Federal Reserve meetings, where policy decisions are announced, potentially impacting the market’s direction.

-

Corporate Events: The calendar also includes significant corporate events, such as mergers, acquisitions, spin-offs, and stock splits. These events can significantly impact a company’s stock price and attract investor attention.

-

Industry-Specific Reports: Beyond the general market, the calendar often includes reports specific to certain industries, such as retail sales figures, manufacturing data, or energy production statistics. These reports provide valuable insights into the performance of particular sectors.

The Importance of the Stock Market Reporting Calendar:

-

Informed Decision-Making: By providing a clear roadmap of upcoming reports and announcements, the calendar empowers investors to make well-informed decisions. It allows them to anticipate potential market movements, adjust their investment strategies, and capitalize on opportunities.

-

Market Volatility Awareness: The calendar highlights periods of increased market volatility, when significant reports or announcements are expected. This awareness enables investors to manage risk and navigate potential market fluctuations effectively.

-

Strategic Planning: The calendar helps investors plan their investment strategies around upcoming events. For example, they can identify potential investment opportunities ahead of earnings reports or economic indicators that are expected to have a significant impact on the market.

-

Performance Tracking: The calendar facilitates tracking the performance of individual companies and the overall market. By comparing actual results to expectations, investors can assess the progress of their investments and make necessary adjustments.

FAQs about the Stock Market Reporting Calendar:

1. Where can I find the stock market reporting calendar?

Several online resources offer comprehensive stock market reporting calendars, including financial news websites, brokerage platforms, and dedicated financial data providers.

2. How often is the calendar updated?

The calendar is typically updated regularly, often on a daily or weekly basis, to reflect changes in reporting dates and announcements.

3. What are the key dates to watch out for on the calendar?

Key dates to watch out for include earnings report releases, Federal Reserve meetings, and major economic indicators.

4. How can I use the calendar to improve my investment strategy?

The calendar can help you identify potential investment opportunities, manage risk, and track the performance of your investments.

5. Is the calendar a guarantee of market performance?

While the calendar provides valuable insights, it is not a guarantee of market performance. Market movements can be influenced by a wide range of factors, and the information provided in the calendar should be considered alongside other market data.

Tips for Utilizing the Stock Market Reporting Calendar:

-

Customize your calendar: Focus on the reports and announcements that are relevant to your investment portfolio and interests.

-

Stay informed: Monitor the calendar regularly and keep abreast of any updates or changes.

-

Analyze the reports: Don’t simply rely on headlines. Dig deeper into the reports to gain a comprehensive understanding of the underlying data and its implications.

-

Consider the broader context: Evaluate reports within the context of the overall market environment, economic indicators, and industry trends.

-

Don’t panic: Market volatility is normal. Avoid making impulsive decisions based solely on a single report or announcement.

Conclusion:

The stock market reporting calendar serves as an indispensable tool for investors navigating the complexities of the financial markets. It provides a structured framework for understanding the flow of information, enabling investors to make informed decisions, manage risk, and capitalize on opportunities. By leveraging the calendar, investors can gain a significant edge in their investment journey, fostering greater confidence and maximizing their potential for success.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Labyrinth: Understanding the Stock Market Reporting Calendar. We hope you find this article informative and beneficial. See you in our next article!