Navigating the Future of Payroll: A Comprehensive Guide to 2025 Payroll Calendar Templates

Related Articles: Navigating the Future of Payroll: A Comprehensive Guide to 2025 Payroll Calendar Templates

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Future of Payroll: A Comprehensive Guide to 2025 Payroll Calendar Templates. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future of Payroll: A Comprehensive Guide to 2025 Payroll Calendar Templates

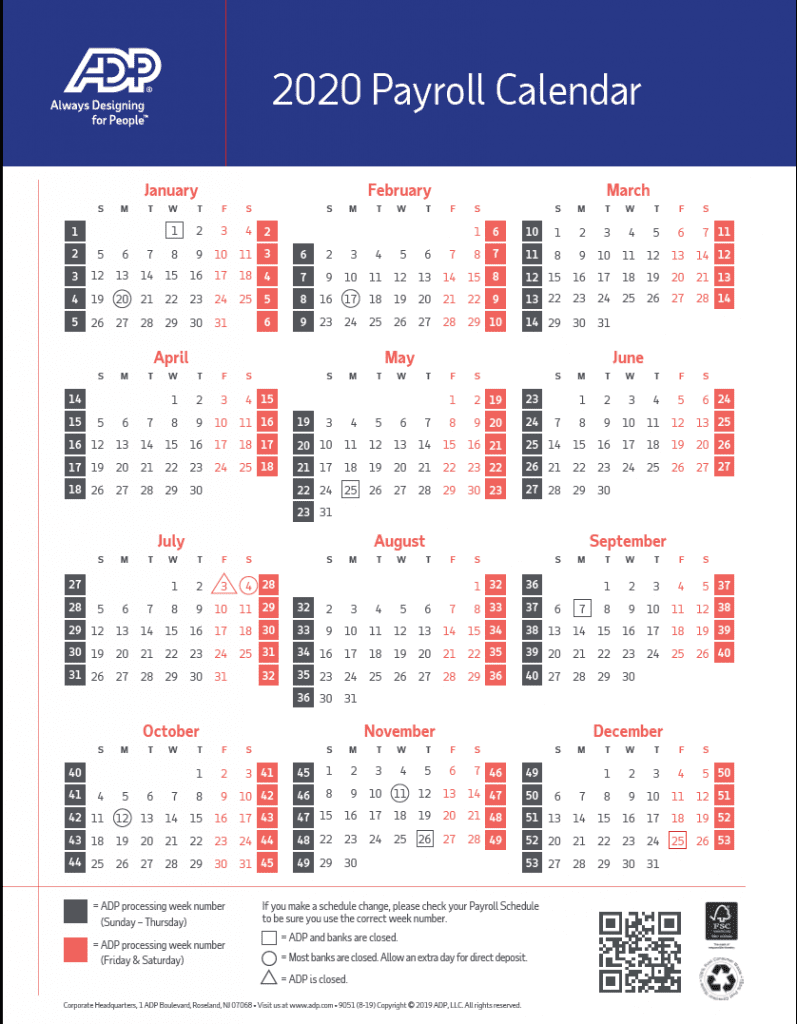

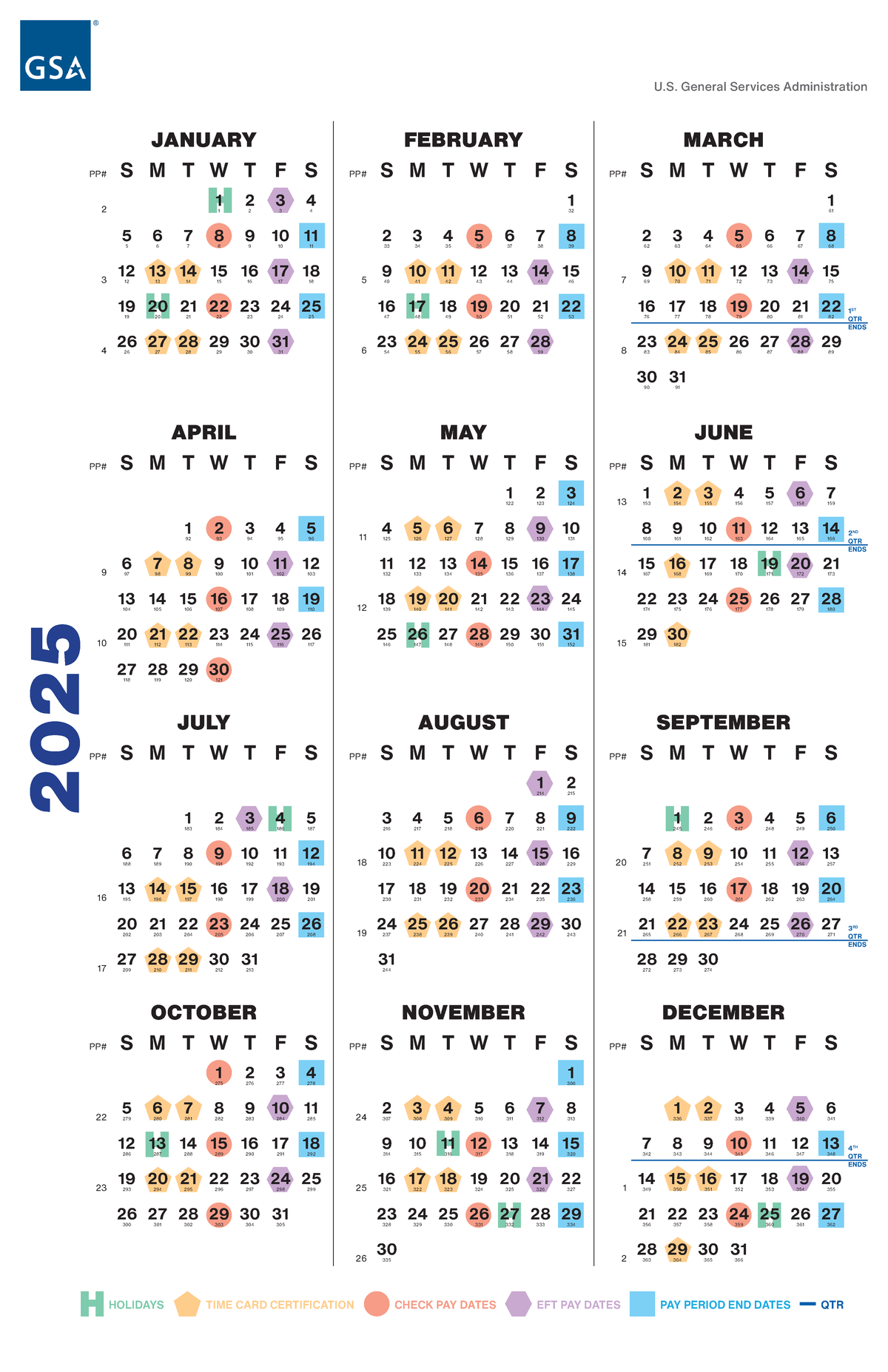

The year 2025 may seem distant, but for businesses, planning ahead is crucial, especially when it comes to payroll. As technology evolves and regulations shift, the need for efficient and accurate payroll management will only intensify. This is where the 2025 payroll calendar template emerges as a vital tool for organizations of all sizes.

Understanding the Significance of a Payroll Calendar Template

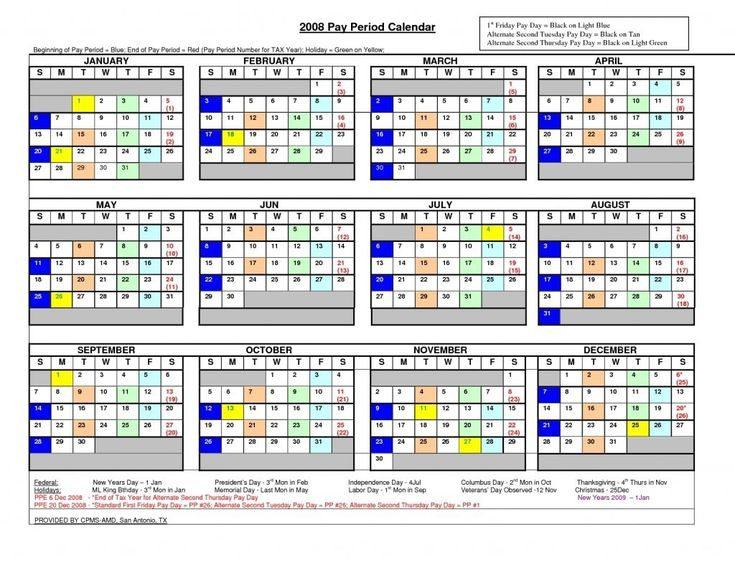

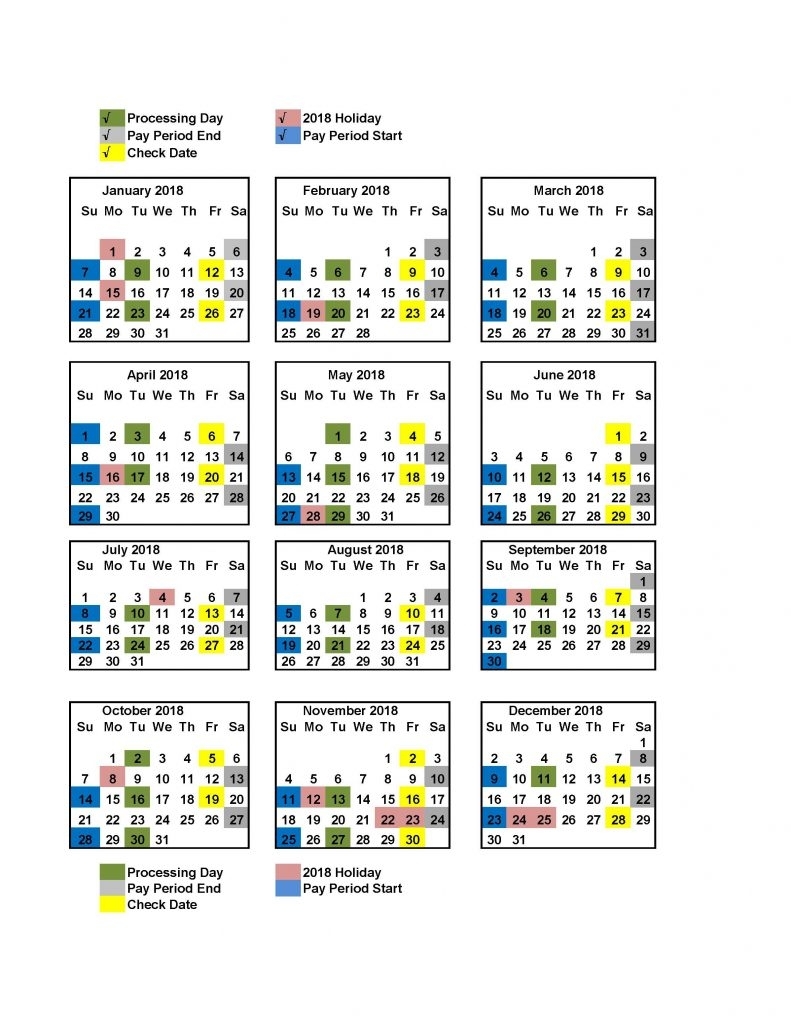

A payroll calendar template acts as a blueprint for efficient payroll processing. It outlines key dates for payroll activities, including:

- Payday: The date when employees receive their salaries.

- Payroll Filing Deadlines: The deadlines for submitting payroll tax information to relevant authorities.

- Tax Payment Due Dates: The dates when payroll taxes must be remitted.

- Employee Benefit Deadlines: Deadlines for enrolling in or making changes to employee benefits programs.

- Annual Filing Requirements: Dates for filing annual tax returns and other regulatory reports.

Benefits of Utilizing a 2025 Payroll Calendar Template:

- Streamlined Payroll Processing: A well-structured calendar ensures timely and accurate payroll processing, minimizing errors and potential penalties.

- Enhanced Compliance: By outlining tax deadlines and regulatory requirements, the calendar helps businesses adhere to legal obligations, reducing the risk of fines and legal issues.

- Improved Cash Flow Management: A clear understanding of payroll expenses and tax obligations allows for better budgeting and cash flow management, ensuring financial stability.

- Reduced Administrative Burden: Automating payroll tasks through the calendar template frees up valuable time for HR and finance teams, allowing them to focus on strategic initiatives.

- Enhanced Employee Satisfaction: Prompt and accurate payroll payments contribute to employee satisfaction and foster a positive work environment.

Key Features of a Comprehensive 2025 Payroll Calendar Template:

- Flexibility and Customization: The template should be adaptable to different payroll frequencies (weekly, bi-weekly, monthly) and accommodate various payroll systems.

- Integration with Payroll Software: The template should seamlessly integrate with existing payroll software, automating data entry and eliminating manual errors.

- Real-Time Updates: The calendar should provide real-time updates on regulatory changes and tax deadlines, ensuring compliance with the latest regulations.

- Automated Reminders: The template should offer automated reminders for upcoming deadlines and important payroll activities, minimizing the risk of missed deadlines.

- Reporting and Analytics: The calendar should provide robust reporting and analytics capabilities, allowing businesses to track payroll trends, identify cost-saving opportunities, and make informed decisions.

Factors to Consider When Creating or Choosing a 2025 Payroll Calendar Template:

- Payroll Frequency: The template should reflect the company’s payroll frequency (weekly, bi-weekly, monthly) to ensure accurate scheduling of payroll activities.

- Tax Jurisdiction: The template should be tailored to the specific tax jurisdiction(s) where the company operates, taking into account local tax laws and regulations.

- Employee Benefits: The calendar should incorporate deadlines for employee benefits programs, such as health insurance, retirement plans, and flexible spending accounts.

- Company-Specific Requirements: The template should be customized to reflect any unique company policies or procedures related to payroll.

FAQs Regarding 2025 Payroll Calendar Templates:

Q: What are the key legal and regulatory considerations for payroll in 2025?

A: Payroll regulations are constantly evolving. In 2025, businesses should stay informed about potential changes to federal and state tax laws, minimum wage laws, overtime regulations, and employee benefits requirements.

Q: How can a payroll calendar template help with compliance?

A: By outlining deadlines for tax filings, tax payments, and other regulatory requirements, the calendar acts as a compliance roadmap, reducing the risk of penalties and legal issues.

Q: What are the benefits of using a cloud-based payroll calendar template?

A: Cloud-based templates offer real-time updates, accessibility from multiple devices, enhanced collaboration among team members, and automatic data backups, ensuring data security and availability.

Q: Can a payroll calendar template be used for different payroll frequencies?

A: Yes, a well-designed template should be flexible enough to accommodate different payroll frequencies, such as weekly, bi-weekly, or monthly.

Q: How can a payroll calendar template help with budgeting and cash flow management?

A: By providing a clear overview of payroll expenses and tax obligations, the calendar allows for better budgeting and financial planning, ensuring sufficient funds are available to meet payroll obligations.

Tips for Implementing a 2025 Payroll Calendar Template:

- Collaborate with Your Payroll Team: Involve your payroll team in the design and implementation of the template, ensuring it aligns with existing processes and addresses their specific needs.

- Regularly Review and Update: Make sure the calendar is updated regularly to reflect changes in regulations, tax laws, and company policies.

- Integrate with Existing Systems: Integrate the calendar with existing payroll software and other HR systems to streamline data entry and automate tasks.

- Communicate with Employees: Inform employees about the new calendar and its benefits, ensuring they understand the importance of accurate and timely payroll information.

- Monitor and Evaluate: Track the performance of the calendar and make necessary adjustments based on feedback from your payroll team and other stakeholders.

Conclusion

A 2025 payroll calendar template is an indispensable tool for navigating the complexities of payroll management. By streamlining payroll processing, enhancing compliance, improving cash flow management, and reducing administrative burdens, it empowers businesses to optimize their payroll operations and focus on achieving their strategic goals. As we move closer to 2025, proactive planning and the adoption of advanced payroll tools will be crucial for businesses to thrive in an evolving landscape.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future of Payroll: A Comprehensive Guide to 2025 Payroll Calendar Templates. We hope you find this article informative and beneficial. See you in our next article!