Maximizing Rewards: A Comprehensive Guide to Chase Card Cash Back Calendars

Related Articles: Maximizing Rewards: A Comprehensive Guide to Chase Card Cash Back Calendars

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Maximizing Rewards: A Comprehensive Guide to Chase Card Cash Back Calendars. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Maximizing Rewards: A Comprehensive Guide to Chase Card Cash Back Calendars

In the competitive landscape of credit cards, rewards programs are a key differentiator. Among the many options available, Chase offers a unique and potentially lucrative approach to cash back rewards: the Chase Card Cash Back Calendar. This calendar, frequently updated and accessible online, outlines specific categories that earn increased cash back each month, providing cardholders with the opportunity to strategically maximize their rewards.

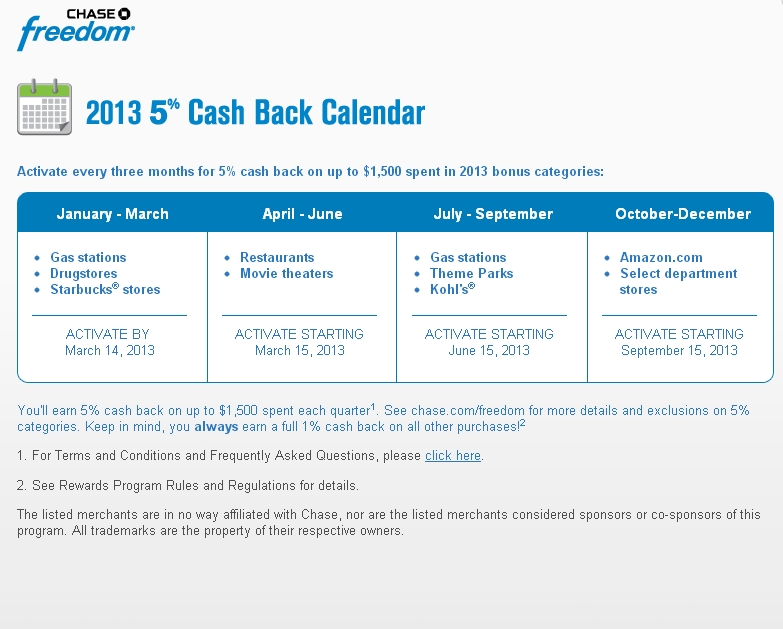

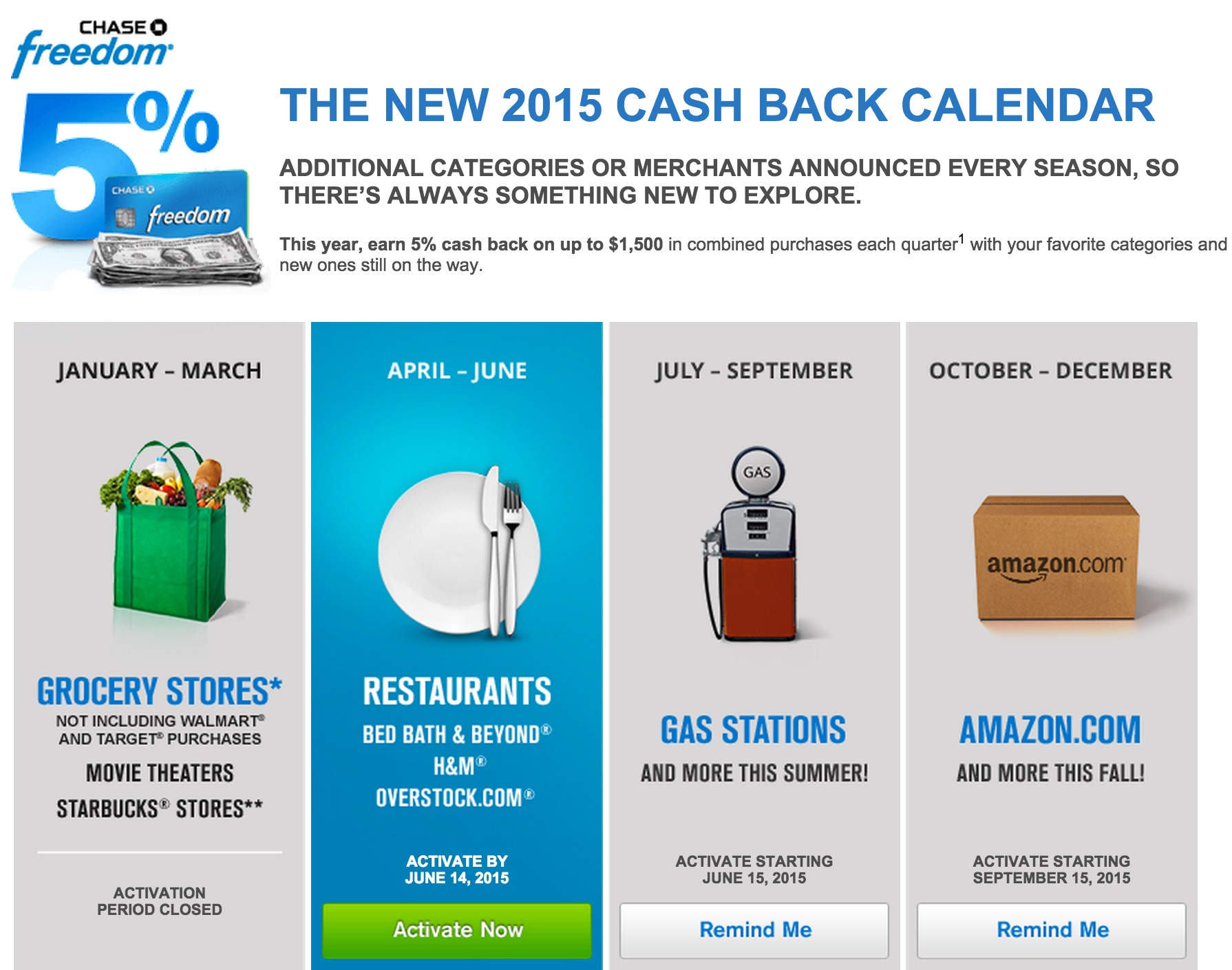

Understanding the Chase Card Cash Back Calendar

The Chase Card Cash Back Calendar is a dynamic tool that allows cardholders to identify the categories where their spending will yield the highest cash back rewards each month. This calendar typically features a rotating selection of categories, offering enhanced cash back percentages for purchases within those designated areas.

Benefits of Utilizing the Chase Card Cash Back Calendar

- Increased Rewards Potential: By aligning spending with the calendar’s highlighted categories, cardholders can significantly increase their cash back earnings. This strategy allows them to earn more rewards for their everyday purchases.

- Flexibility and Adaptability: The rotating nature of the calendar provides flexibility, allowing cardholders to adjust their spending habits to align with the categories offering the highest cash back percentages.

- Enhanced Financial Management: The calendar encourages a more conscious approach to spending, prompting cardholders to consider the potential rewards associated with different purchase categories.

- Targeted Spending: The calendar encourages a strategic approach to spending, enabling cardholders to focus their purchases on areas that offer the most lucrative rewards.

Navigating the Chase Card Cash Back Calendar

- Locate the Calendar: The Chase Card Cash Back Calendar is typically accessible through the Chase website or mobile app.

- Identify Eligible Categories: The calendar clearly outlines the categories that qualify for enhanced cash back during a specific month.

- Check for Restrictions: It is crucial to review the calendar for any limitations or exclusions associated with the eligible categories.

- Maximize Rewards: Strategically plan purchases to align with the categories offering the highest cash back percentages.

Types of Chase Cards with Cash Back Calendars

- Chase Freedom Flex: This card features a rotating quarterly bonus category, earning 5% cash back on up to $1,500 in purchases within that category.

- Chase Freedom Unlimited: While this card offers a flat 1.5% cash back on all purchases, it also benefits from the Chase Card Cash Back Calendar, allowing cardholders to earn additional 5% cash back on eligible categories.

Frequently Asked Questions (FAQs) about the Chase Card Cash Back Calendar

Q: How often does the Chase Card Cash Back Calendar change?

A: The calendar typically updates on a quarterly basis, with new categories becoming eligible for enhanced cash back every three months.

Q: Can I earn cash back on all purchases using the calendar?

A: No, the calendar only applies to specific categories. However, many Chase cards also offer a base cash back rate on all purchases.

Q: What happens if I exceed the spending limit for a bonus category?

A: Once the spending limit for a bonus category is reached, the standard cash back rate applies to any further purchases within that category.

Q: How do I redeem my cash back rewards?

A: Cash back rewards can typically be redeemed for statement credit, deposited into a bank account, or used to purchase gift cards.

Tips for Maximizing Chase Card Cash Back Calendar Rewards

- Plan Ahead: Review the calendar in advance to identify upcoming bonus categories and plan your spending accordingly.

- Track Spending: Keep track of your spending within the bonus categories to ensure you maximize your rewards.

- Consider Combining Cards: If you have multiple Chase cards, consider using the card with the highest cash back rate for eligible purchases.

- Utilize Chase Offers: Chase frequently offers targeted promotions and deals, which can further enhance your cash back earnings.

Conclusion

The Chase Card Cash Back Calendar is a valuable tool for cardholders seeking to maximize their rewards. By strategically aligning spending with the calendar’s highlighted categories, individuals can earn significant cash back on their everyday purchases. Understanding the calendar’s features, navigating its offerings, and utilizing it effectively can lead to substantial financial rewards. Remember to review the calendar regularly, plan your spending strategically, and take advantage of available opportunities to maximize your cash back earnings.

![How To Maximize Your Chase Ultimate Rewards Points [2020]](https://upgradedpoints.com/wp-content/uploads/2016/03/Chase_Ultimate_Rewards_Gift_Card_Best_Value.png)

Closure

Thus, we hope this article has provided valuable insights into Maximizing Rewards: A Comprehensive Guide to Chase Card Cash Back Calendars. We thank you for taking the time to read this article. See you in our next article!