Mastering Your Finances: The Power of a Bill Calendar

Related Articles: Mastering Your Finances: The Power of a Bill Calendar

Introduction

With great pleasure, we will explore the intriguing topic related to Mastering Your Finances: The Power of a Bill Calendar. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Mastering Your Finances: The Power of a Bill Calendar

In the intricate dance of modern life, managing finances effectively is a crucial step towards achieving financial stability and peace of mind. A bill calendar, a simple yet powerful tool, emerges as a steadfast ally in this endeavor. It serves as a central hub for organizing and tracking financial obligations, allowing individuals to navigate the complexities of bill payments with ease and confidence.

Understanding the Value of a Bill Calendar

At its core, a bill calendar acts as a personalized financial roadmap, providing a comprehensive overview of upcoming financial obligations. It empowers individuals to anticipate and prepare for payments, eliminating the stress of missed deadlines and potential late fees. This proactive approach fosters a sense of control over personal finances, enabling individuals to make informed decisions about spending and saving.

The Benefits of Implementing a Bill Calendar

Beyond its organizational prowess, a bill calendar offers a multitude of benefits that significantly enhance financial well-being:

-

Improved Financial Visibility: By centralizing all bill-related information, a calendar provides a clear and concise snapshot of upcoming financial commitments. This transparency allows individuals to assess their financial standing and plan accordingly, ensuring that they have sufficient funds available to meet their obligations.

-

Enhanced Time Management: The calendar serves as a visual reminder of upcoming deadlines, preventing missed payments and the associated penalties. It allows individuals to allocate time for bill payment tasks efficiently, minimizing the risk of last-minute scrambling and stress.

-

Reduced Financial Stress: Knowing exactly when bills are due and having a plan in place to meet those obligations significantly reduces financial anxiety. This sense of control fosters a calmer and more secure financial environment.

-

Improved Budgeting and Savings: The calendar facilitates a more informed approach to budgeting. By analyzing past spending patterns and upcoming bills, individuals can develop realistic budgets and identify areas where they can save.

-

Enhanced Debt Management: For those with outstanding debts, a bill calendar can be instrumental in managing repayment schedules. By tracking due dates and payment amounts, individuals can prioritize debt repayment and work towards becoming debt-free.

Types of Bill Calendars

The modern landscape offers diverse options for bill calendars, catering to various preferences and technological comfort levels:

-

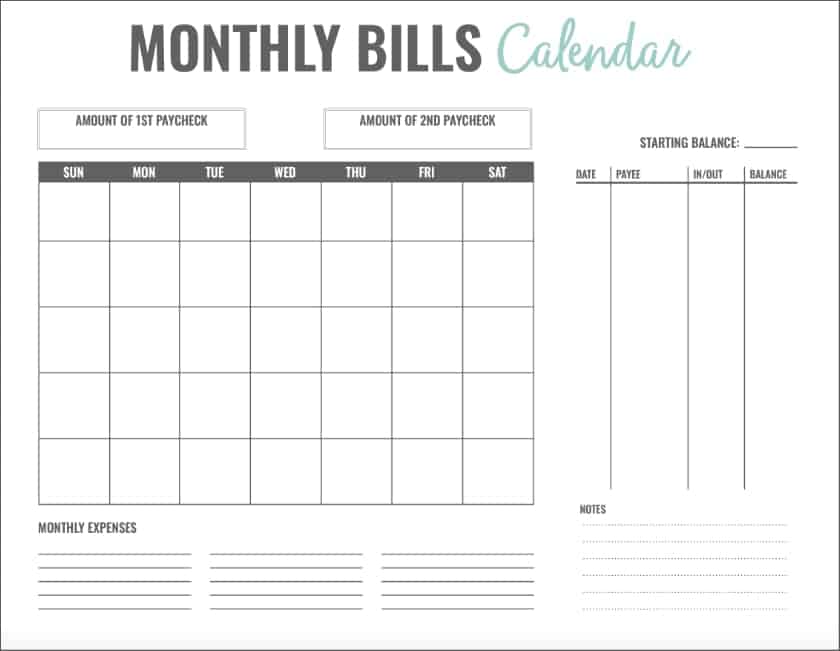

Traditional Paper Calendars: These classic options provide a tangible and customizable platform for managing bills. Individuals can manually record due dates, payment amounts, and any relevant notes.

-

Digital Calendars: Digital calendars, accessible through smartphones, computers, or dedicated apps, offer a convenient and flexible approach. They allow for reminders, automated notifications, and synchronization across multiple devices.

-

Spreadsheets: For those comfortable with spreadsheets, a dedicated spreadsheet can serve as an effective bill calendar. It allows for detailed tracking of payments, interest rates, and other relevant financial information.

-

Financial Management Apps: Numerous financial management apps incorporate bill tracking features, integrating with bank accounts and providing automated reminders.

Implementing a Bill Calendar: A Step-by-Step Guide

Creating and maintaining an effective bill calendar requires a systematic approach:

-

Gather Relevant Information: Compile a list of all recurring bills, including due dates, payment amounts, and contact information for each biller.

-

Choose a Format: Select a bill calendar format that aligns with your preferences and technological comfort level.

-

Populate the Calendar: Enter all bill due dates into your chosen format.

-

Set Reminders: Configure reminders for upcoming due dates, ensuring that you receive timely notifications.

-

Regularly Update: Make it a habit to update the calendar as new bills arise or as payment information changes.

-

Review and Adjust: Periodically review your bill calendar to ensure accuracy and make any necessary adjustments to your budgeting or payment strategies.

FAQs Regarding Bill Calendars

Q: What are the best bill calendar apps available?

A: Several highly-rated bill calendar apps are available, including Mint, Personal Capital, YNAB (You Need a Budget), and EveryDollar. These apps offer features like bill tracking, budgeting, and financial analysis.

Q: How often should I review my bill calendar?

A: It’s recommended to review your bill calendar at least monthly, or more frequently if your financial situation is dynamic. This allows you to stay on top of upcoming payments and make necessary adjustments.

Q: Can I use a bill calendar to manage my debt?

A: Yes, a bill calendar can be a valuable tool for managing debt. By tracking due dates and payment amounts for loans, credit cards, and other debts, you can prioritize repayment and stay on track with your debt reduction goals.

Tips for Maximizing the Benefits of a Bill Calendar

-

Color-Code Your Bills: Use different colors or symbols to categorize bills (e.g., utilities, credit cards, subscriptions), enhancing visual organization and clarity.

-

Set Payment Reminders: Leverage the reminder features of your chosen calendar to receive timely notifications and avoid late fees.

-

Track Your Payments: Once you’ve made a payment, mark it off on your calendar to ensure accuracy and avoid duplicate payments.

-

Integrate with Budgeting Tools: Consider using your bill calendar in conjunction with budgeting tools to ensure that your spending aligns with your financial goals.

Conclusion

In the realm of personal finance, a bill calendar serves as a potent tool for achieving financial stability and peace of mind. By providing a clear and organized view of upcoming financial obligations, it empowers individuals to proactively manage their finances, reduce stress, and make informed financial decisions. Whether opting for a traditional paper calendar or a digital solution, the benefits of embracing a bill calendar are undeniable. By incorporating this simple yet effective tool into your financial routine, you take a significant step towards financial mastery and a brighter financial future.

Closure

Thus, we hope this article has provided valuable insights into Mastering Your Finances: The Power of a Bill Calendar. We hope you find this article informative and beneficial. See you in our next article!